In a time marked by rising geopolitical tension, fiscal unpredictability, and shifting tax regimes, sophisticated investors are doing what they’ve always done in moments of uncertainty: they’re diversifying. But not just their portfolios. They’re diversifying their residencies, banking relationships, currencies, and jurisdictional exposure.

At the heart of this evolution, Portugal Panorama and Ariete Capital are proud to announce an exclusive partnership with a leading Swiss private bank. This unique collaboration gives qualified investors privileged access to two of the most powerful tools in global wealth planning: a Swiss bank account and a European Golden Visa.

Two key pillars of this modern diversification strategy are:

• Opening a Swiss bank account

• Acquiring a European Golden Visa

Independently, each of these moves carries weight. Together, they represent a formidable alignment of financial security and global mobility.

The Privilege of Swiss Banking

For over a century, Switzerland has remained the benchmark for discretion, institutional stability, and world-class financial services. Yet access to Swiss private banking is no longer as open as it once was. Regulatory tightening and enhanced due diligence have raised the bar and in doing so, made entry a privilege.

For those who gain access, the advantages are considerable:

• Political and economic neutrality: Switzerland remains one of the safest banking jurisdictions on the planet.

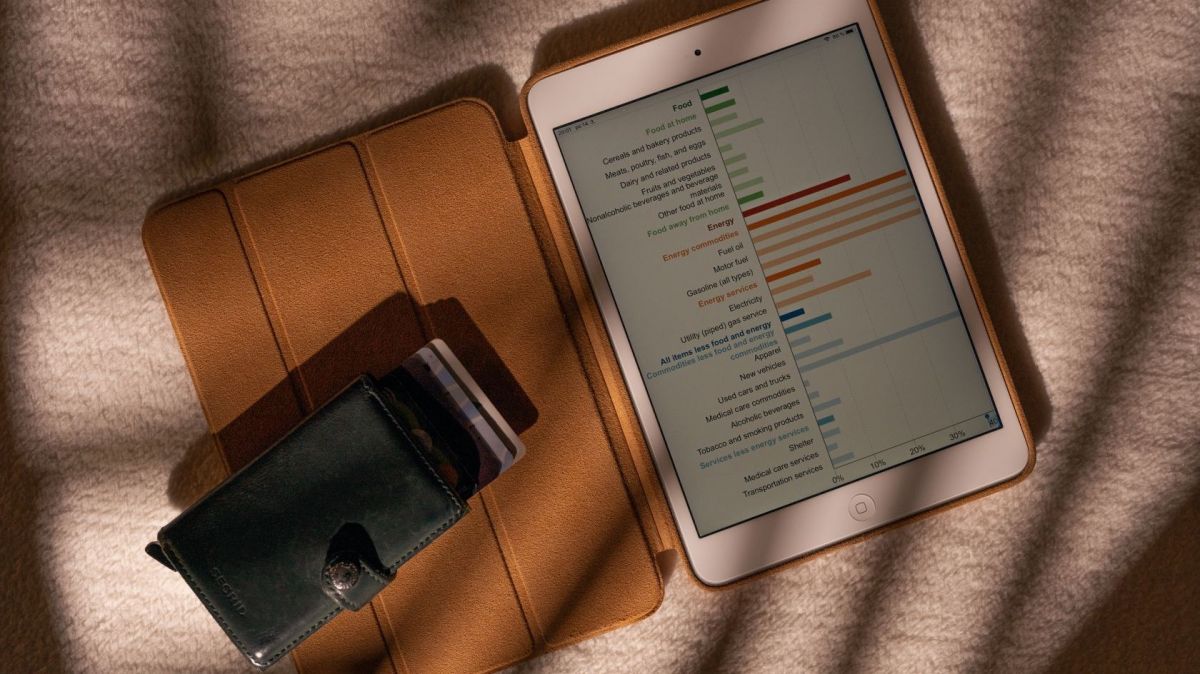

• Multi-currency flexibility: Swiss accounts offer natural hedging against currency devaluation and inflation.

• Professional investment management: From traditional wealth preservation to alternatives and private markets, Swiss banks serve as a trusted partner for generational wealth.

• Discretion with compliance: In an era of global transparency, Swiss banks walk the fine line between discretion and full regulatory alignment.

But even the strongest banking relationship is only one part of the picture. Investors also need physical mobility, asset diversification, and access to new markets.

Enter the European Golden Visa

A Golden Visa, typically through investment in a regulated fund or real estate, grants residency in a European Union country, often with a pathway to citizenship. Portugal, Italy, and Greece remain among the most attractive destinations, offering lifestyle appeal, fiscal incentives, and relative ease of entry.

Beyond residence rights, a European Golden Visa unlocks:

• Tax efficiency: Countries like Portugal and Italy offer beneficial regimes for foreign-sourced income, pension income, and even crypto gains.

• Investment opportunity: EU residency opens the door to onshore investment in regulated European funds, including those focused on private equity, venture capital, or tangible assets such as real estate or classic cars.

• Mobility: Golden Visa holders can travel visa-free throughout the Schengen area - a meaningful advantage in a post-pandemic world of tightened borders and shifting alliances.

A Modern Framework: The Seven Flag Theory

Originally developed by perpetual travelers and refined by global wealth advisors, the Seven Flag Theory advocates placing different aspects of one’s life, residence, citizenship, banking, business, investments, etc. in different jurisdictions to optimize freedom and security.

By simply combining a Swiss bank account with a European Golden Visa, investors already check off several of these strategic “flags”:

1. Legal Residency – EU Golden Visa provides long-term security and a path to citizenship.

2. Tax Residency – Portugal’s NHR or Italy’s Lump Sum Regime enables legal tax optimization.

3. Offshore Banking – Switzerland remains a global fortress for capital preservation.

4. Investment Base – With EU access, investors can deploy capital into compliant, high-performing funds.

5. Business Nexus – Establishing an EU entity unlocks cross-border commerce, IP protection, and market access.

In today’s world, flexibility is the new security. High-net-worth individuals and family offices are no longer content with a single jurisdiction or a single plan. By leveraging the privilege of Swiss private banking alongside the structural benefits of a European Golden Visa, investors build a globally resilient foundation.

Thanks to the exclusive collaboration between Portugal Panorama, Ariete Capital, and a leading Swiss private bank, investors can now access both of these strategic advantages through a streamlined, professionally guided process.

This isn’t about running from risk, it’s about designing a life with options. And in wealth management, optionality is often the greatest luxury of all.

To learn more about how to structure your international investment and residency strategy, visit us at Portugal Panorama or Ariete Capital.

Contact information:

Michael Maxwell - Founder

Portugal Panorama

michael@portugalpanorama.com

+351 965 592 312